grand-club7.ru

Prices

How To Change Your Homeowners Insurance

Your insurance company may require you to send proof of the new insurance policy before your current insurer can cancel your policy. If you paid for your. If you had a $1, deductible for wind storms on your policy, your insurer would pay $2, towards the damage. Using that same example, but changing the. Are you looking to change your homeowners insurance? Read through our complete guide on how to change your homeowners insurance with an escrow account. The problem is that many homeowners have not increased their coverage to meet the changing cost of replacing their homes and may be underinsured in case of loss. When your needs change, your policy can, too. Instead of canceling your homeowners insurance, another option may be updating or changing it. We offer a. Take the lead in shopping for and understanding your insurance policy. Make sure to compare prices, policy coverage and conditions, and complaint information. You can switch your homeowners insurance coverage at any time, even in the middle of a policy term. · Shopping around often can help you find better coverage. If you want to change carriers, you contact the agent for a different carrier. If you actually make the change, your new agent will most likely. You can change your homeowners insurance carrier any time you like. The ideal time is when your policy is set to renew. Typically, homeowners insurance. Your insurance company may require you to send proof of the new insurance policy before your current insurer can cancel your policy. If you paid for your. If you had a $1, deductible for wind storms on your policy, your insurer would pay $2, towards the damage. Using that same example, but changing the. Are you looking to change your homeowners insurance? Read through our complete guide on how to change your homeowners insurance with an escrow account. The problem is that many homeowners have not increased their coverage to meet the changing cost of replacing their homes and may be underinsured in case of loss. When your needs change, your policy can, too. Instead of canceling your homeowners insurance, another option may be updating or changing it. We offer a. Take the lead in shopping for and understanding your insurance policy. Make sure to compare prices, policy coverage and conditions, and complaint information. You can switch your homeowners insurance coverage at any time, even in the middle of a policy term. · Shopping around often can help you find better coverage. If you want to change carriers, you contact the agent for a different carrier. If you actually make the change, your new agent will most likely. You can change your homeowners insurance carrier any time you like. The ideal time is when your policy is set to renew. Typically, homeowners insurance.

Yes. You can. There are a few things to consider, but if you find a better deal on homeowners insurance, in most cases, you should switch your policy over. Yes, to an extent. For the dwelling itself, your limit is calculated by the insurance provider and based on the Replacement Cost Estimate of your home. Just make sure that the new policy is active and in effect before this one ends. Check with your mortgage lender for any payment changes. You'll potentially. Location · Construction type · Amount of insurance · Claims history · Why homeowner premiums are going up · How to save money on your insurance premiums · Footer. Steps to change homeowners insurance providers · 1. Review your current policy · 2. Determine your policy needs · 3. Research different providers and get quotes · 4. Renting out your house? You may want to change your homeowners insurance. Find out if landlord insurance is right for you in our guide today. Preventative measures: Homeowners who take additional precautions to protect their homes may receive additional discounts on their premiums. This includes. Just follow the seven steps below to switch or change your current homeowners insurance with minimum stress. Yes, but because every home is unique you will need a new home insurance policy and it will likely cost a different amount. Here's what you need to know about switching your homeowners insurance policy, as well as a step-by-step guide to getting it done as quickly as possible. When to Make Changes to Your Homeowners Insurance. Allison Hess. We usually recommend you reevaluate your homeowners insurance at least once a year around your. You should shop around around your renewal date every year. If no one can beat the new rate with similar coverage then stick with current insurer. Make sure the cancellation date is on or after your new policy's start date, get paper confirmation that your current policy is canceled and won't be. Homeowners insurance is a type of property insurance that provides financial protection to homeowners Buying, setting up, and servicing your homeowners policy. Here's what you need to know about switching your homeowners insurance policy, as well as a step-by-step guide to getting it done as quickly as possible. Step 1: Gather necessary information · Step 2: Shop around for lower rates · Step 3: Make the switch · Step 4: Inform your lender of the change · Step 5: Leave the. Endorsements are riders, amendments, or attachments to your policy which add, remove or otherwise change the standard coverage of the policy. Although you may. If your insurer merges or restructures with another company, or if your insurer reclassifies your policy (possibly due to an excess of claims), the company must. Yes, but because every home is unique you will need a new home insurance policy and it will likely cost a different amount. Homeowners insurance is a type of property insurance that provides financial protection to homeowners Buying, setting up, and servicing your homeowners policy.

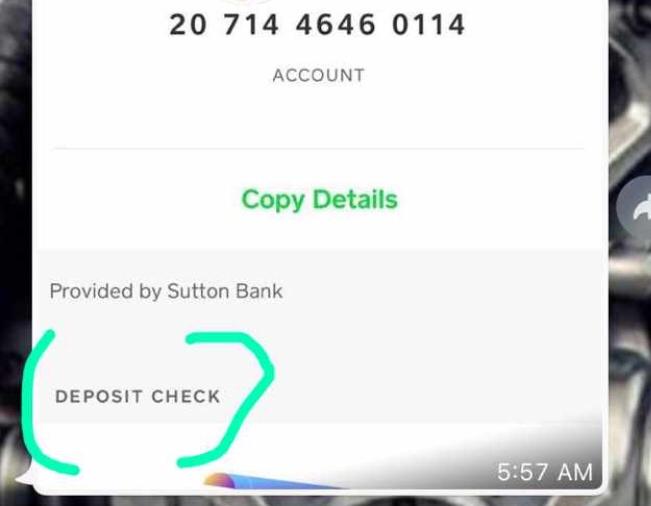

Does Cash App Accept Mobile Deposit

Mobile check deposits are free on Cash App. In other words, you won't have to pay a fee for using the service. The only additional fee you may encounter on Cash. We only accept checks from a U.S. financial institution, in U.S. dollars. The following items are eligible for mobile deposit. You can deposit paper money into your Cash App balance at participating retailers. Cash App charges a flat-rate $1 processing fee on each paper money deposit. Cash App is the easy way to send, spend, save, and invest* your money. Download Cash App and create an account in minutes. SEND AND RECEIVE MONEY INSTANTLY. To deposit a check on Cash App, you will need to have a verified Cash App account and a linked bank account. You can deposit checks up to $7, Discover convenient ways to make your deposits. Options like mobile check deposits, ATMs, and by mail make depositing checks and cash with USAA easy! Yes, you can deposit a check on Cash App. To deposit a check on Cash App, you will need to have a verified account and a linked bank account. You can have your check direct deposited into your Cash App account but you cannot mobile deposit the check. Subscribe to my YouTube channel. Deposit paychecks, tax returns, and more to your Cash App balance using your account and routing number. You can receive up to $25, per direct deposit. Mobile check deposits are free on Cash App. In other words, you won't have to pay a fee for using the service. The only additional fee you may encounter on Cash. We only accept checks from a U.S. financial institution, in U.S. dollars. The following items are eligible for mobile deposit. You can deposit paper money into your Cash App balance at participating retailers. Cash App charges a flat-rate $1 processing fee on each paper money deposit. Cash App is the easy way to send, spend, save, and invest* your money. Download Cash App and create an account in minutes. SEND AND RECEIVE MONEY INSTANTLY. To deposit a check on Cash App, you will need to have a verified Cash App account and a linked bank account. You can deposit checks up to $7, Discover convenient ways to make your deposits. Options like mobile check deposits, ATMs, and by mail make depositing checks and cash with USAA easy! Yes, you can deposit a check on Cash App. To deposit a check on Cash App, you will need to have a verified account and a linked bank account. You can have your check direct deposited into your Cash App account but you cannot mobile deposit the check. Subscribe to my YouTube channel. Deposit paychecks, tax returns, and more to your Cash App balance using your account and routing number. You can receive up to $25, per direct deposit.

Take photos of the front and back of your endorsed eligible check using our app. You'll get immediate confirmation that the deposit was received. It's. How can I access mobile check deposit? · Endorse (sign) the back of the check · Open the One app · Open Cash Control · Choose Deposit Check · Enter the amount of the. Direct deposits can take between 1–5 business days to arrive in your Cash App from the scheduled arrival date. You can only access this feature by downloading the Academy Bank mobile app. Which devices or phones currently allow mobile check deposit? Cash App makes direct deposits available as soon as they are received, up to two days earlier than many banks. Yes, you can deposit a check on Cash App. To deposit a check on Cash App, you will need to have a verified account and a linked bank account. Financial Control at your Fingertips. With the The Check Cashing Store® Mobile app, you can now deposit your checks directly to your bank account or your. In other words, you can use it to accept direct deposits of your pay from an employer. This would make cash app a checking account, because it's. With the GO2bank TM app, you can safely and easily cash checks right from your phone and get your money when you need it. With the Ingo® Money App, cash paychecks, business checks, personal checks—almost any type of check—anytime, anywhere. Get your money in minutes. How Do You Deposit a Check Using Cash App? · Open up the Cash App. Tap the green box icon that has a white dollar sign inside. Make sure that you're signed into. Cash App is the #1 finance app in the App Store. Pay anyone instantly. Save when you spend. Bank like you want to. Buy stocks or bitcoin with as little as. CASH CHECKS AND GET YOUR MONEY IN MINUTES With the Ingo® Money App, cash paychecks, business checks, personal checks—almost any type of check—anytime. Take a picture of the front of the check. Then flip it over, make sure you've signed the back, and take a picture. Enter the amount you're depositing. Add a. With Mobile Check Deposit, you can deposit paper checks securely by phone or tablet anytime, anywhere in the U.S. Learn about the convenience of making a. Take a pic, cash your check. · Say bye to bank visits with in app check cashing · How to use Cash a Check · Mobile check deposit FAQ · Find more ways to manage your. With the GO2bank TM app, you can safely and easily cash checks right from your phone and get your money when you need it. Go to the Capital One Mobile app and select your account. Click on “deposit” next to the camera icon. Take photos of the front and back of your check (please. Deposit checks from almost anywhere with the Bank of America® Mobile Banking app on your smartphone or tablet. Receive a confirmation so you know right away. You can only access this feature by downloading the Academy Bank mobile app. Which devices or phones currently allow mobile check deposit?

Workers Compensation For Self Employed

We know how to help you file for workers' compensation benefits even if you are self-employed. There are many cases where this is possible. You can get workers compensation through Woligo () and selecting option 2 or by filling out the form here so an expert insurance agent can call you. Accordingly, general contractors routinely require that subcontractors provide proof of their own workers' compensation coverage in order to co-work on the job. Generally speaking, employers and companies in North Carolina are not required to purchase workers' compensation coverage for independent contractors. In most instances, if you're self-employed, you won't be required by law to obtain workers' compensation insurance. However, the coverage can be a great way. Yes. Workers' compensation can provide coverage for people who are self-employed. While it may not be required by law, many business owners opt to purchase. If you are a self-employed worker, you typically aren't eligible to be covered by the workers' compensation coverage of the party for whom you render services. Generally, workers comp doesn't cover owners. If you get hurt on the job, your health insurance will ask to see if they can have someone else. Though states generally do not require self-employed independent contractors to have workers' comp insurance, there are other reasons to have coverage. Some. We know how to help you file for workers' compensation benefits even if you are self-employed. There are many cases where this is possible. You can get workers compensation through Woligo () and selecting option 2 or by filling out the form here so an expert insurance agent can call you. Accordingly, general contractors routinely require that subcontractors provide proof of their own workers' compensation coverage in order to co-work on the job. Generally speaking, employers and companies in North Carolina are not required to purchase workers' compensation coverage for independent contractors. In most instances, if you're self-employed, you won't be required by law to obtain workers' compensation insurance. However, the coverage can be a great way. Yes. Workers' compensation can provide coverage for people who are self-employed. While it may not be required by law, many business owners opt to purchase. If you are a self-employed worker, you typically aren't eligible to be covered by the workers' compensation coverage of the party for whom you render services. Generally, workers comp doesn't cover owners. If you get hurt on the job, your health insurance will ask to see if they can have someone else. Though states generally do not require self-employed independent contractors to have workers' comp insurance, there are other reasons to have coverage. Some.

Answer: Since , every independent contractor who is injured while working is an employee of the person for whom he or she performs work unless the. The short answer: it depends. While independent contractors are not eligible for workers' compensation in New York, whether you are considered an “employee”. employed by that limited liability company may waive in In Maine, employers who qualify may also self‐insure their workers' compensation exposure on. You cannot deduct any portion of the insurance premium from an employee's wages. In Colorado, there are two ways for an employer to obtain workers' compensation. You must either obtain workers' compensation coverage for yourself or complete a form indicating you wish to reject that coverage. Are Independent Contractors Allowed to Purchase Workers' Compensation Insurance? Since independent contractors are considered self-employed, they are both the. employed by that limited liability company may waive in In Maine, employers who qualify may also self‐insure their workers' compensation exposure on. Accordingly, general contractors routinely require that subcontractors provide proof of their own workers' compensation coverage in order to co-work on the job. By law, these people are considered to be self-employed, and they are not eligible for workers' compensation coverage or benefits. Knowing this, you might. Self-Employed Workers & Independent Contractors In the state of Oklahoma, when you work completely by yourself, there isn't a requirement to carry workers'. A sole proprietor (self-employed individual) working in his or her Workers' compensation is an employee benefit which must be provided by the employer. Sole-proprietors, partners and self-employed persons are not required to carry workers' compensation on themselves but may elect to be covered, per RSA A Sole proprietors may voluntarily purchase worker's compensation insurance to cover his or her own work-related injuries and illnesses. The answer generally depends on the choices you make for your business. In Ohio, any business with employees–even a single employee–is required to carry. Yes, every California employer using employee labor, including family members, must purchase Workers' Compensation Insurance (Labor Code Section ). If you. A worker is anyone you pay to do work for you who is not an independent contractor. You do not have to provide workers' compensation coverage to independent. Workers' comp also protects business owners who want to avoid any costly situations. Does a sole proprietorship need workers' compensation coverage? Even as a. By law, these people are considered to be self-employed, and they are not eligible for workers' compensation coverage or benefits. Knowing this, you might. All employers are required to carry workers' compensation for their employees, including themselves if they are an employee of their company. This requirement. If you are self-employed and don't have employees, you may still need workers' compensation insurance. For the most part, it depends on the state in which you.

Selling Partial Shares

![]()

This new trading feature lets you buy the stock of companies or ETFs based on a dollar amount, as opposed to how many whole shares you are able to buy for the. purchasing, and selling of Fractional Shares for your Public Investing brokerage account. Orders for Fractional Shares. • For purchases made outside of an. Fractional trading hours are am to pm ET, or am to pm ET for half-day trading. It is not possible to sell fractional shares in the market. Instead, the company appoints a trustee to buy back the fractional shares from investors, and the. For shares that are available for fractional investing, you can sell fractions directly via one single market order by just entering the number of fractions you. Investors who hold stocks that undergo stock splits and own an odd number of shares would likely end up with a fractional share. For example, if Apple undergoes. Fractional investing lets you buy slices of shares at an equivalent fraction of the price. Fractional investing is very popular among younger generations. In order to buy fractional shares, you will need to open an investment account through either an online broker or a robo-advisor. The main difference between. Fractional shares trading lets you buy portions of a stock or ETF for any amount from $5, so you can own a fraction of a company for less than its stock price. This new trading feature lets you buy the stock of companies or ETFs based on a dollar amount, as opposed to how many whole shares you are able to buy for the. purchasing, and selling of Fractional Shares for your Public Investing brokerage account. Orders for Fractional Shares. • For purchases made outside of an. Fractional trading hours are am to pm ET, or am to pm ET for half-day trading. It is not possible to sell fractional shares in the market. Instead, the company appoints a trustee to buy back the fractional shares from investors, and the. For shares that are available for fractional investing, you can sell fractions directly via one single market order by just entering the number of fractions you. Investors who hold stocks that undergo stock splits and own an odd number of shares would likely end up with a fractional share. For example, if Apple undergoes. Fractional investing lets you buy slices of shares at an equivalent fraction of the price. Fractional investing is very popular among younger generations. In order to buy fractional shares, you will need to open an investment account through either an online broker or a robo-advisor. The main difference between. Fractional shares trading lets you buy portions of a stock or ETF for any amount from $5, so you can own a fraction of a company for less than its stock price.

By buying in fractions, if a company's stock is selling at $1, a share and you invest $, you would own a 20 percent fraction or, put differently, a Invest in your favourite US stocks without the high price tag. Buy fractional shares via the Freetrade app to build a diversified portfolio and have more. The only way to sell fractional shares is through a major brokerage. While such shares aren't available from the stock market, they have value to investors, and. Fractional investing allows you to buy portions of shares instead of purchasing an entire share. With fractional shares, you can invest as little as you. Own a slice of your favorite companies using dollar based investing. Buying fractional shares has never been easier. Discover how it works here. How To Sell Fractional Shares On E*TRADE? · Step 1: Log in to Your E*TRADE Account · Step 2: Select the Stock You Want to Sell · Step 3: Choose the Fractional. As the name suggests, fractional shares are less than a full share of stock. For example, if you buy half a share of Walt Disney (DIS %), that would be an. Customers can select Sell All order action or manually enter the fractional quantity in as long as the order is not a stand alone fraction and as long as the. Rather than holding or converting fractional shares to whole shares, some companies opt to aggregate and sell all of the partial shares in the open market –. How to Buy Fractional Shares. Many online brokerage platforms sell fractional shares, including Fidelity, Charles Schwab and Robinhood. Investing apps such as. Trading fractional shares? · Go to an individual stock's detail page · Select Trade → Buy or Sell · Select Shares or Dollars → Buy in Dollars · Enter the amount. Investors can buy and sell fractional shares using the Moomoo app. However, investors should keep in mind that certain securities may not be available for. Users can only place fractional shares orders during market hours. The trading window is ampm EST. The minimum USD amount for single trade is $5 and. Fractional shares are as their name implies, a fraction of a share or less than one whole share. So, instead of buying one whole share of a company, you can buy. With fractional shares you can divide your investments among more stocks to achieve a more diversified portfolio, and put small cash balances to work quickly to. For shares that are available for fractional investing, you can sell fractions directly via one single market order by just entering the number of fractions you. How Fractional Shares Investing Works from the Brokerage Side. Traditionally, investing was relegated to whole units. With a fractional share, a single share or. Yes, you can. A fractional share is a part of one share of stock. Note, our minimum investment amount for US users on any stock is currently $ The fractional owner is free to sell his/her share at any price he likes. The owner can conduct his/her own research to assess a value for the fraction (how.

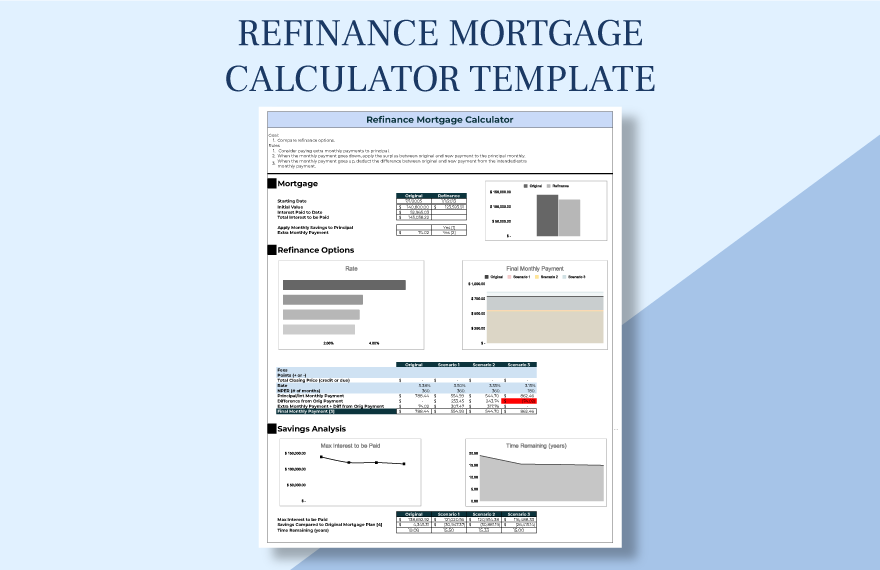

Estimated Refinance Calculator

A mortgage calculator that displays refinancing options for lowering monthly mortgage payments. Calculate your estimated monthly mortgage payments and potential savings with our easy-to-use refinance calculator. If you like what you see, apply online. Use the refinance calculator to find out how much money you could save every month by refinancing. To calculate your DTI ratio, divide your ongoing monthly debt payments by your monthly income. As a general rule, to qualify for a mortgage, your DTI ratio. For loans secured with less than 20% down, PMI is estimated at % of your loan balance each year. Monthly PMI is calculated by multiplying your starting loan. By refinancing your existing loan, your total finance charge may be higher over the life of the loan. Please note that these estimates do not include all. or lower monthly payment? With NerdWallet's free refinance calculator, you can calculate your new monthly payment and estimate your monthly and lifetime savings. Refinancing is estimated to lower your monthly payment by $ and save you $56, in total interest. Your break-even point is approximately 16 months. i · Let. Use Zillow's refinance calculator to determine if refinancing may be worth it. Enter the details of your existing and future loans to estimate your potential. A mortgage calculator that displays refinancing options for lowering monthly mortgage payments. Calculate your estimated monthly mortgage payments and potential savings with our easy-to-use refinance calculator. If you like what you see, apply online. Use the refinance calculator to find out how much money you could save every month by refinancing. To calculate your DTI ratio, divide your ongoing monthly debt payments by your monthly income. As a general rule, to qualify for a mortgage, your DTI ratio. For loans secured with less than 20% down, PMI is estimated at % of your loan balance each year. Monthly PMI is calculated by multiplying your starting loan. By refinancing your existing loan, your total finance charge may be higher over the life of the loan. Please note that these estimates do not include all. or lower monthly payment? With NerdWallet's free refinance calculator, you can calculate your new monthly payment and estimate your monthly and lifetime savings. Refinancing is estimated to lower your monthly payment by $ and save you $56, in total interest. Your break-even point is approximately 16 months. i · Let. Use Zillow's refinance calculator to determine if refinancing may be worth it. Enter the details of your existing and future loans to estimate your potential.

Use our simple mortgage calculator to quickly estimate monthly payments for your new home. This free mortgage tool includes principal and interest. Use our mortgage refinance calculator to estimate the costs and potential savings of refinancing your home. Refinancing your home loan could reduce interest charges or monthly payments. Use MECU Credit Union's Mortgage Refinance Calculator to estimate savings. It lets you takes into account such things as taxes and private mortgage insurance (PMI), so you can get a precise estimate of your true savings. It also lets. Use this refinance calculator to see if refinancing your mortgage is right for you. Calculate estimated monthly payments and rate options for a variety of. Refinancing a home is a big decision and our loan refinance calculator is here to make that decision easier Estimated payments consider only principal and. Use the car refinance calculator to estimate your monthly payments and how much you may be able to save by refinancing your current auto loan. Use our free mortgage calculator to estimate your monthly mortgage payments. Account for interest rates and break down payments in an easy to use. Use our calculator to find out rates, fees, closing costs, and affordability. Compare with typical industry average closing costs. Use our mortgage calculators and other tools to estimate the cost of your home. Calculate monthly payments and what you may be able to borrow with Wells. Use this calculator to estimate how much it will cost you to refinance your home loan. Use this mortgage refinance cost calculator to get an estimate. This Your total estimated refinancing costs will be: $6, Show details. Results. Is your current interest rate on your house too high? Use this free tool to view today's best home loan refi rates from top lenders & estimate your savings at a. Looking to refinance your mortgage? Use our mortgage refinance calculator to estimate your new mortgage terms, loan amount, and interest rates. Our cash-out refinance calculator helps you estimate the monthly payments on your new mortgage. loan term and your estimated mortgage interest rate. Looking to refinance? This refinance closing cost calculator helps you estimate your fees and costs so you'll have an idea of what you can expect to pay. Determine what you could pay each month by using this mortgage calculator to calculate estimated monthly payments and rate options for a variety of loan. Get an official Loan Estimate before choosing a loan. Am I Better Off Refinancing? Save money and lower your monthly payments by refinancing your home. PNC's mortgage refinance calculator can help estimate how much you can save by refinancing your mortgage & determine if now is the right time to refinance. How much cash can you receive through a cash out refinance? · Add up the balances on all your existing home loans such as first mortgages, second mortgages or.

How Much Do You Need To Get A Mortgage

The most you can borrow is usually capped at four-and-a-half times your annual income. It's tempting to get a mortgage for as much as possible but take a. Down payment. This is the amount you pay upfront toward your home purchase. Typically, the recommended amount is 20% of your purchase price. Under certain loan. Input high level income and expense information, along with some loan specific details to get an estimate of the mortgage amount for which you may qualify. Save for a down payment. Your down payment amount depends on several variables, including the house price and loan type. For a conventional loan, you'll want to. How to get more house for your money There are a couple of ways to reduce parts of your mortgage payment and get more house for your money. PMI is generally. Most home loans require a down payment of at least 3%. A 20% down payment is ideal to lower your monthly payment, avoid private mortgage insurance and increase. A general guideline for the mortgage you can afford is % to % of your gross annual income. However, the specific amount you can afford to borrow depends. Mortgage lenders base their decisions on what's known as the loan-to-income ratio – the amount you want to borrow divided by how much you earn. You need to consider your own circumstances and your future financial needs and goals. What do lenders look at when deciding whether or not to finance a. The most you can borrow is usually capped at four-and-a-half times your annual income. It's tempting to get a mortgage for as much as possible but take a. Down payment. This is the amount you pay upfront toward your home purchase. Typically, the recommended amount is 20% of your purchase price. Under certain loan. Input high level income and expense information, along with some loan specific details to get an estimate of the mortgage amount for which you may qualify. Save for a down payment. Your down payment amount depends on several variables, including the house price and loan type. For a conventional loan, you'll want to. How to get more house for your money There are a couple of ways to reduce parts of your mortgage payment and get more house for your money. PMI is generally. Most home loans require a down payment of at least 3%. A 20% down payment is ideal to lower your monthly payment, avoid private mortgage insurance and increase. A general guideline for the mortgage you can afford is % to % of your gross annual income. However, the specific amount you can afford to borrow depends. Mortgage lenders base their decisions on what's known as the loan-to-income ratio – the amount you want to borrow divided by how much you earn. You need to consider your own circumstances and your future financial needs and goals. What do lenders look at when deciding whether or not to finance a.

If you're just starting out, you can establish a credit history good enough to qualify for a mortgage within two years. This requires that you have a mix of. Understand how much house you can afford. This mortgage affordability calculator provides an idea of your target purchase price, and it's based on some. What credit score do you need to buy a house? We'll cover why credit scores matter in the mortgage process and how to maximize your score. A credit score. If you're a first-time homebuyer, you have a variety of options for obtaining a mortgage. Here are some home financing basics that can help you make the. You have at least a credit score · You can make a down payment between 3% and 20% · You want a loan with mortgage insurance that you can get rid of as you. You can typically submit two to three months' worth of bank statements to show your balance. Depending on how you've set up your account, you might get these. Ideally, your mortgage payment shouldn't take up more than 28% of your gross (pre-tax) income, according to Brian Walsh, a certified financial planner and. That depends on the purchase price of your home and your loan program. Different loan programs require different percentages, usually ranging from 5% to 20%. The housing expense, or front-end, ratio is determined by the amount of your gross income used to pay your monthly mortgage payment. Most lenders do not want. Mortgage affordability calculator. Get an estimated home price and monthly mortgage payment based on your income, monthly debt, down payment, and location. How much do I need to earn to get a mortgage? There's not a 'set amount' you need to earn to get a UK mortgage. Instead, lenders will look at what you can. Traditionally, a mortgage down payment is at least 5% of a home's sale price. House down payments are often, but not always, part of the normal homebuying. Most lenders do not want your monthly mortgage payment to exceed 28 percent of your gross monthly income. The monthly mortgage payment includes principle. Before you start shopping for a new home, you need to determine how much house you can afford. One way to start is to get pre-approved by a lender, who will. Money Saving Tip: Compare Mortgage Rates. How much money could you save? Compare lenders to find the best loan to fit your needs & lock in your rate today. By. Lenders typically require home loan applicants to have a housing expense ratio of 28% or lower. Why? Because the lower the ratio is between your housing costs. 2. You'll pay more without a minimum 20% down payment · 3. Mortgage fees should be factored in · 4. The higher your credit score, the better · 5. Lenders value job. Lenders divide your total monthly debt payments by your income to determine whether or not you can afford another loan. The higher your down payment, the. How much money do you make each year? Rule of thumb says that your monthly home loan payment shouldn't total more than 28% of your gross monthly income. Gross. To purchase a $1 million home, you must have sufficient income to comfortably cover the monthly mortgage payment. The amount of the payment can vary depending.

Best Secured Credit Card To Start Building Credit

Apply for the BankAmericard® secured credit card to start building your credit and enjoy access to your FICO® Score updated monthly for free. Secured credit cards tend to be a good option for those looking to build or rebuild their credit. And with consistent, responsible use, you can improve your. The OpenSky Secured Visa Credit Card · N/A* · % Variable ; Capital One Quicksilver Secured Cash Rewards Credit Card · %-5% (cash back) · % (Variable). The Discover it® Secured Credit Card is not a prepaid card or a debit card. It's a real credit card that gives rewards with no annual fee. When used responsibly, the Capital One Platinum Secured Credit Card can help you build credit with no annual fee. Yahoo Personal Finance•24 days ago. For those who are trying to build or rebuild their credit, secured cards can be beneficial in helping reach credit goals. Citi® Secured Mastercard® · Citi® Secured Mastercard® · Discover it® Secured Credit Card · Capital One Platinum Secured Credit Card · U.S. Bank Secured Visa® Card. Secured credit cards may help build or establish your credit score if you make consistent on-time payments, avoid late fees and keep your balance low. It looks and acts like a traditional credit card except that you provide a refundable security deposit, which will equal your credit line, of at least $ Apply for the BankAmericard® secured credit card to start building your credit and enjoy access to your FICO® Score updated monthly for free. Secured credit cards tend to be a good option for those looking to build or rebuild their credit. And with consistent, responsible use, you can improve your. The OpenSky Secured Visa Credit Card · N/A* · % Variable ; Capital One Quicksilver Secured Cash Rewards Credit Card · %-5% (cash back) · % (Variable). The Discover it® Secured Credit Card is not a prepaid card or a debit card. It's a real credit card that gives rewards with no annual fee. When used responsibly, the Capital One Platinum Secured Credit Card can help you build credit with no annual fee. Yahoo Personal Finance•24 days ago. For those who are trying to build or rebuild their credit, secured cards can be beneficial in helping reach credit goals. Citi® Secured Mastercard® · Citi® Secured Mastercard® · Discover it® Secured Credit Card · Capital One Platinum Secured Credit Card · U.S. Bank Secured Visa® Card. Secured credit cards may help build or establish your credit score if you make consistent on-time payments, avoid late fees and keep your balance low. It looks and acts like a traditional credit card except that you provide a refundable security deposit, which will equal your credit line, of at least $

Credit cards to help build or rebuild credit can create a brighter financial future when handled responsibly. The best secured credit card to rebuild credit with is the US Bank Cash+® Visa® Secured Card because it has a $0 annual fee, reports to the credit bureaus, and. A secured credit card is one of the best ways to build or improve credit. Learn more about what it is and how it works here. A secured Credit Card from Fifth Third Bank is a smart way to help you establish or rebuild good credit. Apply today. Best for rewards: Discover it® Secured Credit Card · Best for a low deposit: Capital One Platinum Secured Credit Card · Best for high potential credit limit. First Progress Platinum Elite Mastercard® Secured Credit Card · Choose your own credit line – $ to $ – based on your security deposit · Build your credit. The TD Cash Secured Visa Credit Card is a great way to build or repair credit, earn cash back, plus fraud protection, online banking & more. Us bank secured is good Amazon secured is good fizz or chime are good it depends where you spend most of your money. Rewards while working on your credit. Win-win. Earn up to 3% cash back on gas and EV charging, and 2% on utilities and groceries (with a combined $1, Capital One Platinum Secured Credit Card · No annual or hidden fees. · Building your credit? · Put down a refundable security deposit starting at $49 to get a $ No credit history required, the Discover it® Secured Credit Card offers one of the best credit cards for building or rebuilding a healthy credit history, while. The Chime Credit Builder Secured Visa Credit Card earned a spot on our list for having no minimum security deposit, no annual fee, and no interest APR. Start building and improving your credit with a Capital One Platinum Secured credit card great option if you want to improve or build your credit. Find out if. You have not favorited any cards · PREMIER Bankcard® Mastercard® Credit Card · Merit Platinum Card · Secured Chime Credit Builder Visa® Credit Card · Surge. What is the best credit card to build credit? The U.S. Bank Secured Visa Card is a secure, convenient payment solution for building or re-establishing credit. Purchases made with the Secured Visa Card are. The difference is that it requires a cash security deposit that the lender “holds” to secure the funds. They're an ideal way for people to build credit or. Apply & start building credit with the Citi® Secured Mastercard®, a Citi great benefits that come with your card. Learn how to get started and how. If you go Capital One, go Quicksilver secured as it at least earns %. The Platinum has no rewards and 30% APR. Secured credit cards may be especially helpful for high-risk borrowers or those with little to no credit history. If you're trying to build or improve your.